Impact Of Returns, Risk On Interest In Investing During The Covid-19 Pandemic

DOI:

10.51601/ijersc.v2i5.170Published:

2021-11-05Downloads

Abstract

This study aims to determine the effect of return, risk on interest in investing

during the covid 19 pandemic. The population in this study were all

customers of the Indonesia Stock Exchange (IDX) Pangkalpinang City with

a total sample of 377 respondents. The sampling technique was carried out

using a non-probability sampling method, namely the accidental sampling

technique. This type of research is quantitative research with primary data

types obtained directly through the distribution of online questionnaires

using google form. This research uses multiple regression analysis

technique.The results of this study indicate that (1) the return variable has a

significant effect on interest in investing during the covid 19 pandemic. (2)

the risk variable has a significant effect on interest in investing during the

covid 19 pandemic. (3) the attitude variable has a significant effect on

interest in investing during the pandemic. covid 19. The conclusion of this

study shows that IDX customers have a good understanding of returns and

risks, and have a positive attitude towards investing during the covid 19

pandemic, encouragement from those closest to them as well as the

confidence from within customers to invest, greatly affects customer

investment interest during the covid 19 pandemic.

Keywords:

Return, Risk, Investment Interest, Covid 19 Pandemic.References

Ajzen, I. (1991). “The Theory Of Planned Behavior”. Organizational Behavior And

Human Decision Processes, 50(2), 179-211.

Armando, F. (2019). “Analisis Faktor-Faktor Yang Mempengaruhi Minat Mahasiswa

Untuk Berinvestasi Di Pasar Modal (Studi Kasus Pada Mahasiswa Di Bandar Lampung)”.

(Doctoral Dissertation, IIB Darmajaya).

Diana, N. (2018). “Analisis Faktor-Faktor Yang Mempengaruhi Minat Penggunaan

Electronic Money Di Indonesia”. Fakultas Ekonomi, Universitas Islam Indonesia

Yogyakarta.

Ghozali, Imam dan Karlina Aprilia Kusumadewi (2016). Model Persamaan Structural:

Partial Least Square (PLS), Generalized Structure Component Analisys (GSCA) And

Regularized Generalized Canonical Correlation Abalisys (RGCCA). Semarang: Yoga

Pratama.

Rahmawati, N., & Maslichah, M. (2018). “Minat Berinvestasi Di Pasar Modal: Aplikasi

Theory Planned Behaviour Serta Persepsi Berinvestasi Di Kalangan Mahasiswa (Studi

Kasus Pada Mahasiswa Akuntansi Fakultas Ekonomi Universitas Islam Malang)”. Jurnal

Ilmiah Riset Akuntansi, 7(01).

[7] Seni, N. N. A., & Ratnadi, N. M. D. (2017). “Theory Of Planned Behavior Untuk

Memprediksi Niat Berinvestasi”. E-Jurnal Ekonomi Dan Bisnis Universitas Udayana,

, 4043-68.

Sugiyono. (2017). “Metode Penelitian Kuantitatif, Kualitatif dan R&D”. Bandung,

Alfabeta.

Sitinjak, E. L. M. (2020). “Perilaku Investor Pasar Modal Masa Pandemi Covid-19”.

Tandio, T., & Widanaputra, A. G. (2016). “Pengaruh Pelatihan Pasar Modal, Return,

Persepsi, Risiko, Gender, Dan Kemajuan Teknologi Pada Minat Investasi Mahasiswa”. EJurnal Akuntansi, 16(3), 2316-2341

License

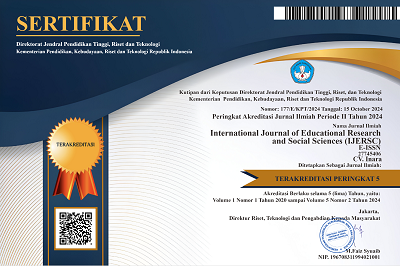

Copyright (c) 2021 International Journal of Educational Research & Social Sciences

This work is licensed under a Creative Commons Attribution 4.0 International License.