The Role Of The Village Head In Earth And Building Tax Withdrawal In Papahan Village, Tasikmadu District, Karanganyar Regency During The Covid-19 Pandemic

DOI:

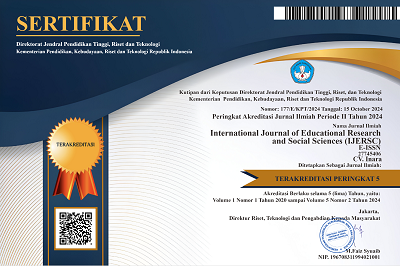

10.51601/ijersc.v3i1.297Published:

2022-02-28Downloads

Abstract

Land and Building Tax is one of the sources of financing for regional development and other sources. In urban and rural areas, the intensification and extensification of land and building tax collection will increase state revenues. Land and Building Tax receipts will be submitted to the Regency/Municipal and Village Governments using a percentage system. Tax sanctions impact the provisions of laws that have been given are disobeyed. The greater the error made, the taxpayer will be subject to severe sanctions if the taxpayer does not carry out his obligations, namely by paying taxes. This study uses a normative juridical approach to qualitative legal research by analyzing library materials or secondary data. This study draws conclusions derived from interpreting laws relevant to the topics discussed. In addition, this study also analyzes the legal principles used to formulate research objectives. The strategies used in optimizing tax collections include evaluating taxpayers to analyze names that are not always punctual in paying taxes taking firmness in the form of warnings to taxpayers who do not pay taxes. Several sanctions have been attached, conducting regular and periodic counseling to taxpayers who are expected to provide insight into the timeliness of paying taxes. They have quality resources to assist in data input and updating in an integrated system.

Keywords:

Land and building tax, village head, Covid-19References

M. Syukur, “Insentif Pajak terhadap Sumbangan Covid-19 dari Perspektif Relasi Hukum Pajak Indonesia dengan Hak Asasi Manusia,” Jurnal Suara Hukum, vol. 2, no. 2, 2020, doi: 10.26740/jsh.v2n2.p184-214.

R. Syaiful, “Pengaruh kesadaran wajib pajak, administrasi perpajakan, dan sanksi pajak terhadap kepatuhan wajib pajak pajak bumi dan bangunan,” Artikel, 2016.

B. Leophaza and M. V. Juita, “Pengaruh Pelayanan Pajak, SPPT Dan Kesadaran Wajib Pajak Terhadap Kepatuhan Wajib Dalam Membayar Pajak Bumi dan Bangunan (PBB) Di Desa Karangsentul Kecamatan Gondang Wetan Kabupaten Pasuruan Tahun,” Journal of Economic And Business, vol. 1, no. 1, 2020.

Republik Indonesia, “Undang-Undang No. 33 Tahun 2004 tentang Perimbangan Keuangan antara Pemerintah Pusat dan Pemerintahan Daerah,” 15 Oktober, vol. 2004, 2004.

E. Rahmawan, “Optimalisasi Pemungutan Pajak Bumi dan Bangunan (PBB) di kecamatan Limpasu Kabupaten Hulu Sungai Tengah,” Jurnal ilmu Politik dan Pemerintahan Lokal, vol. I, pp. 23–39, 2012.

Z. . Nafiah and W. . Warno, “Pengaruh Sanksi Pajak, Kesadaran Wajib Pajak, Dan Kualitas Pelayanan Pajak Terhadap Kepatuhan Wajib Pajak Dalam Membayar Pajak Bumi Dan Bangunan (Study Kasus Pada Kecamatan Candisari Kota Semarang Tahun 2016),” Jurnal Stie Semarang, vol. 10, no. 1, pp. 86–105, 2018, doi: 10.33747/stiesmg.v10i1.88.

F. S. Elva Nuraina, “Pengaruh sanksi perpajakan terhadap kepatuhan wajib pajak orang pribadi di Kantor Pelayanan Pajak Pratama Madiun,” EQUILIBRIUM : Jurnal Ilmiah Ekonomi dan Pembelajarannya, vol. 5, no. 1, 2017, doi: 10.25273/equilibrium.v5i1.1005.

H. Ramadhan, “Pajak Penghasilan Terhadap Tenaga Kerja Asing Sebagai Subyek Hukum Pajak,” Media Iuris, vol. 1, no. 2, p. 266, 2018, doi: 10.20473/mi.v1i2.8830.

F. Kusno, “Krisis Politik Ekonomi Global Dampak Pandemi Covid-19,” Anterior Jurnal, vol. 19, no. 2, 2020, doi: 10.33084/anterior.v19i2.1495.

D. A. D. Nasution, E. Erlina, and I. Muda, “Dampak Pandemi COVID-19 terhadap Perekonomian Indonesia,” Jurnal Benefita, vol. 5, no. 2, 2020, doi: 10.22216/jbe.v5i2.5313.

R. A. Mardiyah and R. N. Nurwati, “Dampak Pandemi Covid-19 Terhadap Peningkatan Angka Pengangguran di Indonesia,” vol. 2, 2020.

A. Johan, F. Hikmah, and A. Anditya, “Perpajakan Optimal dalam Perspektif Hukum Pajak Berfalsafah Pancasila,” Jurnal Magister Hukum Udayana (Udayana Master Law Journal), vol. 8, no. 3, p. 317, 2019, doi: 10.24843/jmhu.2019.v08.i03.p03.

A. Lutfi and A. Prawira, “Pembangunan Drainase Berakibat Kepada Hak Pengguna, Problem Pengguna Jalan Dan Perkembangan Ekonomi (Studi Kasus Di Kota Bukittinggi),” Elkahfi| Journal of Islamic …, vol. 1, no. 1, 2020.

N. Afifah, M. H. Paramita, and N. K, “Tinjauan Pelaksanaan Ekstensifikasi Dan Intensifikasi Pajak Sebagai Upaya Peningkatan Penerimaan Pajak,” Jurnal Analisa Akuntansi dan Perpajakan, vol. 3, no. 2, 2020, doi: 10.25139/jaap.v3i2.2192.

Helti Kristiana Advina, “Analisis faktor-faktor yang mempengaruhi pajak daerah serta tingkat efisiensi dan efektivitas dalam pemungutan (studi kasus di Kabupaten Karanganyar),” UNS-F. Ekonomi Jur. Ekonomi Pembangunan-F.1106008-2010, no. Pajak Daerah, 2010.

N. Sesarista, “Pengaruh Pengetahuan Perpajakan, Kualitas Pelayanan Pajak, Sosialisasi, dan Sanksi Perpajakan Terhadap Kepatuhan Wajib Pajak Dalam Membayar PBB-P2 di Kota Tangerang Selatan,” Tax & Accounting Review, vol. 21, no. 1, 2020.

License

Copyright (c) 2022 International Journal of Educational Research & Social Sciences

This work is licensed under a Creative Commons Attribution 4.0 International License.