The Influence Of Performance Expectancy, Effort Expectancy, Social Influence, Facilitating Conditions, And Financial Literacy On Use Behavior Of Buy Now Pay Later Services With Behavior Intention As A Mediating Variable Among Generation Z In The Bandung Raya Area

DOI:

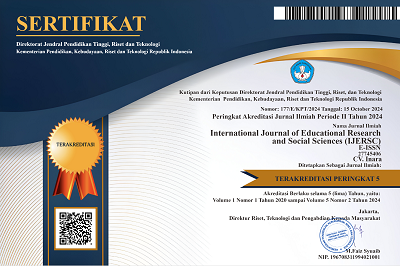

10.51601/ijersc.v6i2.981Published:

2025-06-29Downloads

Abstract

Growing presence of Buy Now Pay Later (BNPL) services has significantly influenced the way consumers conduct digital transactions. Generally structured as short-term, interest-free credit, these services have rapidly gained traction—especially among younger generations in Indonesia, BNPL services have been on the rise, with significant growth in the number of contracts signed for these services. According to the Financial Services Authority (OJK) report (2023) the number of BNPL contracts in Indonesia reached nearly 80 million in 2023, showing an average annual growth rate of 144.35% in the last five years. This research aims to analyze the factors that influence young people, especially Generation Z, in adopting buy now pay later services. In addition, research was conducted to examine the factors that influence user behavior using the Unified Theory of Acceptance and Use of Technology (UTAUT) theory with the addition of Financial literacy variables. This research uses descriptive research with quantitative methods. The research sample was obtained using 400 respondents. Data was obtained through questionnaires distributed to Gen Z in Greater Bandung. The data was then analyzed with the Statistical Package for Social Science (SPSS). The results showed that the variables of effort expectancy, social influence, and financial literacy have a significant influence on behavior intention. Furthermore, performance expectancy, financial literacy and behavior intention have a significant effect on use behavior. Based on the results of mediation testing, social influence and financial literacy have a significant effect on use behavior through behavior intention as a mediating variable.

References

Abed, S. S., & Alkadi, R. S. (2024). Sustainable Development through Fintech: Understanding the Adoption of Buy Now Pay Later (BNPL) Applications by Generation Z in Saudi Arabia. Sustainability (Switzerland), 16(15).

Cook, J., Davies, K., Farrugia, D., Threadgold, S., Coffey, J., Senior, K., Haro, A., & Shannon, B. (2023). Buy Now Pay Later Services as a Way to Pay: Credit Consumption and the Depoliticization of Debt. Consumption Markets and Culture, 26(4), 245–257. https://doi.org/10.1080/10253866.2023.2219606

deHaan, E., Kim, J., Lourie, B., & Zhu, C. (2024). Buy Now Pay (Pain?) Later. Management Science, 70(8), 5586–5598. https://doi.org/10.1287/mnsc.2022.03266

Gerrans, P., Baur, D. G., & Lavagna-Slater, S. (2022). Fintech and Responsibility: Buy-Now-Pay-Later Arrangements. Australian Journal of Management, 47(3), 474–502.

Ghozali, I. (2018). Aplikasi Multivariate Dengan Program IBM SPSS (9th ed.). Badan Penerbit Universitas Diponogoro.

Juita, V., Pujani, V., Rahim, R., & Rahayu, R. (2023). The Influence of User’s Digital Financial Literacy and Perceived Risks on Buy Now Pay Later (BNPL) Adoption: A Gender’s Perspective (pp. 629–645). https://doi.org/10.2991/978-94-6463-350-4_63

Mahande, D. R., & Jasruddin. (2018). UTAUT Model: Suatu Pendekatan Evaluasi Penerimaan E-Learning pada Program Pascasarjana. Osf. https://doi.org/10.31227/osf.io/254j7

Mahir, A. W., Budi, P., Kartawinata,R.,&Akbar,A.(2023).Financial Technology 4.0 Indonesia Perspective 2023.

Mavridis, A., & Gebeyehu, F. (2023). Buy Now, Pay Later: Assessing the Financial and Behavioral Implications for Gen-Z Consumers in the USA. www.bth.se

OECD. (2023). OECD/INFE 2023 International Survey of Adult Financial Literacy.

Oliveira, T., Faria, M., Thomas, M. A., & Popovič, A. (2014). Extending the Understanding of Mobile Banking Adoption: When UTAUT Meets TTF and ITM. International Journal of Information Management, 34(5), 689–703. https://doi.org/10.1016/j.ijinfomgt.2014.06.004

Sugiyono, Prof. D. (2022). Metode Penelitian Kuantitatif, Kualitatif, dan R&D (2nd ed.). Alfabeta.

Tuan, P. Van, Tram, N. T. P. T., Chi, V. M., Hao, N. T., Linh, N. K., & Anh, N. P. D. (2024). Factors Affecting the Intention to Buy Now - Pay Later for Online Payment of Generation Z. Journal of Business and Econometrics Studies, 1–6. https://doi.org/10.61440/JBES.2024.v1.12

Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User Acceptance of Information Technology: Toward a Unified View. MIS Quarterly: Management Information Systems, 27(3), 425–478.

Wibowo, D. A. M. K. M. S. MM. (2023). Layanan Fintech Dalam Perspektif Hukum, Ekonomi, Dan Teknologi (D. J. T. S. Kom. , M. K. Santoso, Ed.). Yayasan Prima Agus Teknik.

License

Copyright (c) 2025 International Journal of Educational Research & Social Sciences

This work is licensed under a Creative Commons Attribution 4.0 International License.