Effect Of Macroeconomic Factors (Exchange, Inflation, Sbi Interest Rate, World Oil Price) On Stock Returns With Profitability As Intervening Variables In Mining Sector Companies In The Indonesia Stock Exchange 2015-2019

DOI:

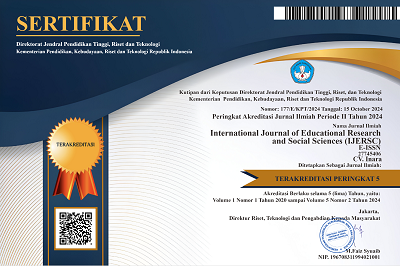

10.51601/ijersc.v3i4.459Published:

2022-09-01Downloads

Abstract

The purpose of this study was to determine and analyze the effect of macroeconomic factors (exchange rate,

inflation, interest rates for Bank Indonesia Certificates, world oil prices) on stock returns with profitability (return

on assets) as an intervening variable in mining sector companies on the Indonesia Stock Exchange in 2015 -2019.

The data used in this study is secondary data obtained from monthly and annual data published by Bank Indonesia,

the Indonesia Stock Exchange, and the Energy Information Administration (EIA) and processed using Path Analysis

with SmartPLS 3.0. The results showed that macroeconomics (exchange rate of Rp/US$, inflation, SBI interest rates,

world oil prices) and ROA had a direct significant effect on stock returns in the mining sector on the Indonesia Stock

Exchange (IDX). Macroeconomics (Rp/US$ exchange rate, inflation and world oil prices) have an indirect and

significant indirect effect on Stock Return of the mining sector on the IDX, while the SBI interest rate has a

significant indirect effect on Stock Return of the mining sector on the IDX.

Keywords:

Stock Return, Return on Assets, Exchange Rate, Inflation, SBI Interest Rate, World Oil PriceReferences

Irham. (2012). Manajemen Investasi. Salemba Empat.

Putri, A. P., & Mesrawati. (2017). Pengaruh Analisis Teknikal terhadap Trend Pergerakan Harga Saham Perusahaan Subsektor Hotel dan Restoran. Jurnal Ekonomi Dan Keuangan, 3. https://doi.org/10.24034/j25485024.y2019.v3.i3. 4161

Ong, E. (2016). Technical Analysis for Mega Profit (Kedelapan). Gramedia Pustaka Utama.

Aminullah, Murwaningsari, E., Gunawan, J., & Mayangsari, S. (2018). The Effect of Macro Economic Variables on Stock Return of Companies That Listed in Stock Exchange: Empirical Evidence from Indonesia. International Journal of Business and Management, 14. https://doi.org/10.5539/ijbm.v14n8p108

Chandra, K. (2017). The Effect of Inflation Levels and Oil Prices on Stock Return Food and Beverage. Business and Entrepreneurial Review, 17.

Kurniasari, W., Wiratno, A., & Yusuf, M. (2018). Pengaruh Inflasi dan Suku Bunga terhadap Return Saham dengan Profitabilitas sebagai Variabel Intervening di Perbankan Yang Terdaftar di Bursa Efek Indonesia tahun 2013-2015. Journal of Accounting Science, 2, 67-90. https://doi.org/10.21070/jas.v2i1.1216

Septariani, D. (2020). Pengaruh Nilai Tukar Rupiah terhadap Return Saham Perusahaan Indofarma Tbk Periode 2014-2018. Jurnal Sosio E-Kons, 12, 221–229. https://doi.org/10.30998/sosioekons.v12i3.7548

Geriadi, M. A. D., & Wiksuana, I. G. B. (2017). Pengaruh Inflasi Terhadap Return Saham pada Perusahaan Properti dan Real Estate yang Terdaftar di Bursa Efek Indonesia (Risiko Sistematis dan Profitabilitas sebagai Variabel Mediasi). E-Jurnal Ekonomi Dan Bisnis Universitas Udayana, 3435–3462.

Wulandari, T. (2021). Analisis Pengaruh Varian dan Tingkat Suku Bunga Terhadap Return Saham Studi pada perusahaan IDX30 BEI. Journal Management, Business, and Accounting, 20, 235–247.

Gumilang, R. C., Hidayat, R. R., & NP, M. G. W. E. (2014). Pengaruh Variabel Makro Ekonomi, Harga Emas dan Harga Minyak Dunia terhadap Indeks Harga Saham Gabungan pada BEI Periode 2009-2013. Jurnal Administrasi Bisnis (JAB), 14, 1–9.

Andriana, D. (2015). Pengaruh Nilai Tukar terhadap Harga Saham Setelah Initial Public Offering (IPO). Jurnal Riset Akuntansi Dan Keuangan, 3 (3), 761–767.

Solihatun. (2017). Pengaruh Suku Bunga, Inflasi, Nilai Tukar, Earning Per Share, dan Price Earning Ratio terhadap Return Saham (Studi Kasus pada Perusahaan Pertambangan yang terdaftar di Bursa Efek Indonesia periode 2011-2015). Universitas Negeri Semarang.

Sari, L., Mary, H., Elfiswandi, Zefriyenni, & Lusiana. (2021). Kinerja Perusahaan dan BI Rate terhadap Return Saham Bank BUMN. Jurnal Ekonomi Manajemen Sistem Informasi, 2, 544-555. https://doi.org/10.31933/jemsi.v2i4

Endri, Rinaldi, M., Arifian, D., Saing, B., & Aminudin. (2021). Oil Price and Stock Return: Evidence of Mining Companies in Indonesia. International Journal of Energy Economics and Policy, 11. https://doi.org/10.32479/ijeep.10608

Hanoeboen, B. R. (2017). Analisis Pengaruh Harga Minyak Dunia, Nilai Tukar Rupiah, Inflasi, dan Suku Bunga SBI terhadap Indeks Harga Saham Gabungan (IHSG). Cita Ekonomika, Jurnal Ekonomi, 11, 35–40.

Almira, N. P. A. K., & Wiagustini, N. L. P. (2020). Return on Asset, Return on Equity, and Earning per Share Berpengaruh terhadap Return Saham. E-Jurnal Manajemen, 9. https://doi.org/10.24843/EJMUNUD.2020.v09.i03.p13

License

Copyright (c) 2022 International Journal of Educational Research & Social Sciences

This work is licensed under a Creative Commons Attribution 4.0 International License.